Contents:

Remember, your final decision to trade should be based on your risk tolerance, market expertise, portfolio size and composition. Always conduct your own research before trading, and never trade money you cannot afford to lose. Investors can also use fundamental analysis to identify a market trend by looking at changes in business or economic metrics, such as revenue and earnings growth. Both technical and fundamental analysis can be used to identify market trends.

The world's major banks were found to be – as Warren Buffett famously quipped – swimming naked when the tide went out. Why Silicon Valley Bank collapsed The sudden demise of Silicon Valley Bank last weekend has its origins at the 'safer' end of the financial https://day-trading.info/ spectrum, explains Ian Verrender. "These bond market moves are absolutely mind blowing," bond investor Angus Coote told the ABC. Here was a major equity holder, or owner, of the Swiss bank saying it was not investing another cent in Credit Suisse.

In today's trading session we are monitoring EURAUD for a buying opportunity around 1.58 supply and demand zone at the trend. It was convicted in connection with a money laundering plot involving a drug ring last summer. And it has had substantial entanglements with a collapsed hedge fund and a bankrupt British lender. Wednesday's broad-based fallout was sparked in part when Credit Suisse’s largest shareholder, Saudi National Bank, said it had ruled out adding to its existing investments to help steady the embattled lender. The Swiss National Bank offered the embattled lender financial support if necessary in a statement issued late Wednesday, a move that helped markets pare some of the day’s steep losses. In a world where uncertainty is more a feature than a bug, it’s important to be prepared for market highs and lows, even within the span of the same year.

: Why farmers hate the new tax on 'unrealised gains' on super funds over $3m

For example, the US Federal Reserve’s monetary tightening cycle can be considered a primary trend. To understand what market trend mean, it’s important to note what factors may shape one. Demand, application-specific, pricing, historical market data, and market share information for local companies are all included in the market study. The Densified Laminated Wood Boards research report includes information on the company's marketing tactics, corporate expansion, general structure, and organizational setup. The company report from Densified Laminated Wood Boards provides insightful analyses of the market and consumer data through a variety of graphs and figures.

The chart above shows the long term price action of the Nasdaq 100 stock market index. This index shows the value of the largest 100 technology stocks listed on the NASDAQ Exchange and is used as a barometer for the health of the tech sector. It's clear to see the long term growth in technology shares since 2008 which accelerated during the pandemic. The Foreign Exchange market is where global currencies are traded. It's a decentralized global market that operates 24 hours a day, and is considered the largest by trading volume and the most liquid worldwide.

It became a problem when hundreds of small tech firms, who were also suffering from rising interest rates, went to withdraw cash from the bank. When interest rates rise, the price of bonds fall, and vice versa. Over the past six months the share price has continued to fall and clients have pulled their money out of the business.

Otherwise they might have to increase rates if inflation continues to weigh... The volatility on Wall Street came after Credit Suisse led a selloff in bank stocks as its share price hit a record low Wednesday. The lender’s long-standing problems were compounded when its largest investor, the Saudi National Bank, said earlier this week that it would not offer more financial assistance due to regulatory checks that would kick in.

- It seems nice, with low barriers to entry, generally no commission , high leverage (high risk/high reward), and free trading tools such as charts and research.

- If the pharmaceutical industry manages to get Covid-19 under control during 2021, it will be a triumph for science.

- Not many other industries flourished in the stock market during the 2020 pandemic to the extent of the technology sector.

- In an attempt to calm investors’ nerves, Switzerland’s central bank, the Swiss National Bank, said late in the day that it would step in if necessary to keep Credit Suisse afloat.

A falling bond market tells you interest rates are rising to cool the heat in an economy. This will allow you to trade long and short and potentially profit from rising and falling prices. Let's take a look at how some of these different types of trading markets are shaping up for 2022 onetrade forex broker, onetrade review, onetrade information 2020 and what some of the best markets to trade on could be. Furthermore, you can invest with very competitive low fees and low minimum transactions fees which is ideal for smaller accounts. You can also access state of the art trading platforms, research and premium analytics tools.

These short-term trends are typically shaped by current news and changes in trading volumes. 84% of retail investor accounts lose money when trading CFDs with this provider. Some of the fastest-growing markets for densified laminated wood boards include India, Indonesia, Thailand, Brazil, and South Africa. These countries are witnessing significant growth due to the rising demand for eco-friendly and sustainable building materials from the construction industry. In North America, the market is witnessing significant growth due to the rising construction activities and increased infrastructure spending. In the Asia Pacific, China is the largest market for densified laminated wood boards due to the growing demand for furniture and construction materials.

Making deals now is as hard as in early days of Covid-19, traders say

The bank had faced several scandals, but questions were also being asked about its profitability and the viability of its investment banking division. Open a trading account and see all of the features for yourself first hand. This will then open the window shown below which details all the markets available for you to trade on. From here you can add a wide variety of markets to your Market Watch window by selecting them and clicking Show Symbol. Since then, the price of gold has remained range based but has now broken out of a symmetrical wedge price action pattern. The market has been forecasting higher interest rates for the US dollar and has been positioning itself accordingly.

The research report provides an overview of the company's marketing strategies, revenue development, and overall structure and organization. Densified laminated wood boards are an innovative and environmentally-friendly solution for various building applications. These boards are made by compressing and bonding layers of wood fibers using a specialized manufacturing process. They offer several benefits over traditional wood products, including increased strength, durability, termite resistance, and dimensional stability. A thorough overview of the most recent changes in the global "Densified Laminated Wood Boards Market" from the forecast period 2023 to 2030 is provided in this most recent report from Report Mines.

Two days later, New York regulators shut down Signature Bank, a big lender in the cryptocurrency industry. The S&P was up more than 1% Thursday afternoon, and the Dow Jones Industrial Average gained more than 170 points. A fund that bundles regional bank stocks was trading about 1.4% higher. Credit Suisse’s shares plunged to a new low after the bank’s largest shareholder, Saudi National Bank, ruled out providing it with more money as it struggles with its latest turnaround plan. The Swiss National Bank said it stood ready to support Credit Suisse if necessary, but not before shares across Europe were also hard hit, with stocks of many of the region’s biggest banks falling sharply. TheForex Market Map is updated every 10 minutes throughout the trading day.Forex prices are delayed 10 minutes, per exchange rules, and trade times are listed in CT.

Luckily traders do not need to know what the future will look like 100 years from now. Ultimately, it is simpler to understand what the financial markets might be doing in the short-term rather than in the long term, especially when analysing an entire century. With regular updates throughout each trading session, the Stock Market Today column highlights the latest stock market news and alerts you to any changes in market trend. You'll also get ongoing analysis of the best stocks to buy and watch.

Forex Market Map

Usually a lower interest rate / yield would be positive for stocks but not necessarily in the face of other bad events happening. Testifying before the Senate Finance Committee on Thursday, Treasury Secretary Janet Yellen sought to pacify markets, saying that the financial sector was on stable footing. The yield on the two-year Treasury note, which is particularly sensitive to Fed policy, fell by about a third of a percentage point, a big move for that asset, to around 3.9 percent. Wall Street has been on edge ever since thecollapse of Silicon Valley Bank and Signature Bank, which were seized by regulators after suffering devastating runs on deposits. Policymakers have sought to contain the risks by backstopping lenders, and although those efforts have helped ease concerns, Wednesday’s trading showed that the anxiety isn’t fully resolved.

The market is likely to experience a slow growth rate due to the decline in demand from various end-use industries. Also, the disruptions in the supply chain and logistics may lead to a shortage of raw materials affecting the production and availability of densified laminated wood boards. The major benefactor in this scenario would be the manufacturers capable of adapting to the market dynamics and catering to the changing demand patterns. Moreover, the availability of alternative materials and their cost-effectiveness may also play a vital role in determining the growth of the densified laminated wood boards market.

Revenue of leading data center markets worldwide from 2016 to 2027

The potential next phase is a global credit crunch, which could lead to another worldwide financial crisis, but regulators and central banks are pulling out all stops to prevent that from happening. Once this is done you will have instant access to the Trader's Room! From here, you can open either a live or demo trading account.

Identifying Market Trends

There are, however, also external providers making their IT infrastructure available completely or partially by leasing out capacity in data centers. The United States was the leading data center market by revenue in 2022, with an estimated revenue of around 95 billion U.S. dollars. China was the second largest market with revenue of around 65 billion U.S. dollars in 2022. The sudden collapse of Silicon Valley Bank and Signature Bank, as well as the emerging turmoil at Credit Suisse, comes at a time when the economy grapples with stickier, if declining, inflation. It has sparked a debate among traders betting on whether or not the Fed will hike interest rates after its meeting next week. SVB, the U.S. tech sector’s favorite lender, was shut down last week by regulators, and federal authorities moved quickly thereafter to guarantee all its deposits, including those exceeding the $250,000 insurance limit.

Mortgage rates drop to stall rising trend

First Republic is among a handful of midsize and regional bank stocks that have been under pressure since the collapses of Silicon Valley Bank and Signature Bank. First Republic had the third-highest rate of uninsured U.S. deposits after those two failed lenders. Shortly before the markets opened in the United States, S&P Global Ratings cut the credit rating of First Republic Bank, another American lender that investors are worried about, into so-called junk territory. The S&P 500 ended with a decline of just 0.7 percent after recovering from a larger fall earlier in the day, but trading in bond and commodities markets signaled that investors were worried about the economy.

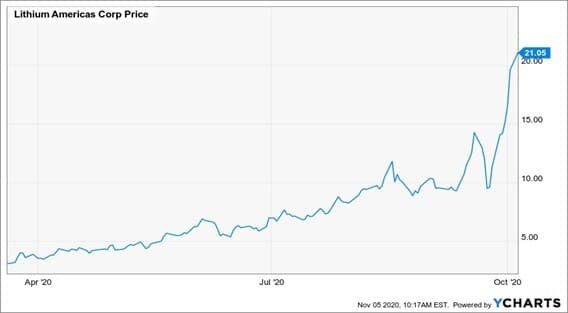

While one can hope nothing as dramatic as a pandemic hits in 2021, Henry expects investors should be ready for another roller-coaster ride next year. “Do you have enough savings that are liquid for things like…a pandemic? And if you found yourself overly stressed or panic selling over the past year, you may want to adjust your investment strategies to include more fixed-income investments in the new year. Food delivery services fell sharply, too, as did similar stocks.