You’ll need to provide documentation to show a lender this information in order to qualify for a commercial loan. Traditional lenders like banks and credit unions are a common source of commercial loans and your chance of qualifying are better today than a few years ago. Forbes reported that business loan approval rates from large banks were the highest they’ve been in about a decade, since the last recession. But even though traditional lenders are approving more loans, they still may have the toughest standards and application process. Even though the SBA has small business in their name, their loan programs are extensive enough that they can be useful for medium-sized businesses looking for commercial loans. However, when you apply for an SBA loan, you will pay some additional fees to the government.

While there are a few exceptions (including commercial property owned by an individual), the overwhelming majority of commercial loans are extended to business entities like corporations and partnerships. As is the case with an individual consumer, businesses are still required to have certain creditworthiness. This is one of the most important factors that a bank will take into consideration when offering a commercial loan. The Small Business Administration (SBA) is a federal government agency that helps small businesses and entrepreneurs grow and succeed. The SBA offers a variety of lending programs to help you meet your financing needs.

Types of Commercial Loans

Many lenders also offer financing and lease options for both new and used equipment. This allows you to grow while finding solutions that keep your cash flowing. If no real estate is available, and you are trying to buy or borrow against some equipment, you would apply for an equipment loan to either a bank or an equipment finance company. You could also apply to a leasing company to just lease the equipment. The collateral available to serve as the security for your commercial loan determines the type of commercial loan you can get and the kind of lender to whom you should apply. Bridge loans vary greatly in price, depending on the quality of the deal and the borrower.

The borrower only has to pay interest on the amount of the construction loan that has been drawn down to date. In other words, the interest payment in month one is usually very small because the developer has used very little of the loan proceeds. These visits are called progress inspections, and there is small fee to the borrower for each one. While lenders set their own borrowing criteria, they typically require at least two years in business, good credit and annual revenue that demonstrates the ability to afford the debt obligation. What’s more, commercial business loans usually require collateral—a business asset that secures the loan and the lender can repossess in case the business defaults. Likewise, commercial loans from banks represent an important source of funding for corporations, partnerships, and sole proprietorships that make up the business sector.

The Commercial Loan Process

As mentioned earlier, a commercial loan is best suited for mid-sized companies, those with $10 million a year in revenue or more. These are the companies where it makes sense to take out larger amounts through a commercial loan. If your business is looking for less money, focus on small business loans instead.

- Eligibility requirements vary, but your company must be defined as a business by the SBA and you can’t be delinquent on any other debts.

- Forbes reported that business loan approval rates from large banks were the highest they’ve been in about a decade, since the last recession.

- The good news is that there are several different types of commercial loans you can explore.

- So long as you repay your loan, that won’t be an issue, but if you fail to pay back your commercial loan, you could lose the collateral.

- There is a lot to look forward to and several opportunities available to pursue.

- Credit Unions - Credit unions have come out of nowhere in recent years to seize 6% of the commercial real estate loan market.

The funding amounts, fees, terms, and interest rates that your business will be subjected to will hinge on your financial goals, credit history, and the type of loan you apply for. Many commercial loan officers play a significant role in finding and attracting new business for the bank. Loan officers approach business owners to offer financing and to build ongoing relationships. At the same time, clients approach the bank with a need and meet with the loan officer to find out if they qualify for financing. SBA commercial loans — SBA commercial loans are part of a government program run by the Small Business Administration. They offer similar commercial loan options, like term, real estate and lines of credit.

You will need to qualify for a commercial loan and this application takes some work. Different lenders have different standards, but you can usually expect them to consider your credit score, business history, current revenues and assets. Commercial real estate loans — These loans will help your business buy a new piece of property, like a new or second office, warehouse or manufacturing facility. Commercial real estate loans are for the largest amounts of money and have the longest length. Finally, qualifying for a commercial loan can be more difficult, since the lender will be giving out more money and the stakes are higher.

Types of Commercial Business Loans

The bank will look into credit scores as well as if your business has solid cash flow. So if both of these are on the lower end, it could be difficult to get approval. If you’re approved for a commercial loan, the rate of interest you’re going to have to pay will typically align with the prime lending rate. After the loan has been issued, you will also likely need to provide the bank with regular financial statements.

It’s likely your lender will also require that you meet a minimum annual revenue requirement. Although this varies by lender, you can expect requirements of around $250,000 annually. This helps the lender make sure that you can afford to pay back the loan in full and on time. This is due to various causes, including an improving economy, increased employment, and increased demand for small and medium-sized firms. As a result of the increased demand, lenders have expanded their offers and increased the number of financing choices available.

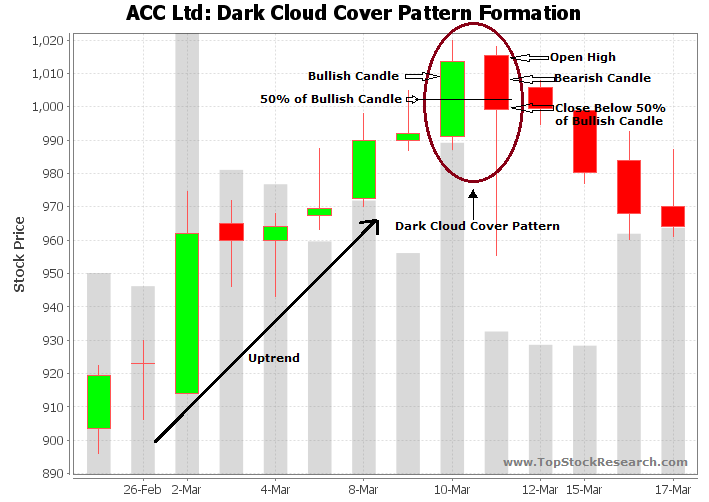

A large number of these cookie-cutter commercial real estate loans are then assembled into a portfolio, assigned to a trust, and then securitized. Conduits offer terrific rates on commercial real estate loans, but their loans have lock-out clauses and huge prepayment penalties. Most require that the business owner has good personal credit (FICO score of at least 670); they may also check your business’s credit score if it has one.

SBA 7(a) Loans

Get started here and find out more about how to get a loan for land. And now you’re ready to execute the plan that you started with to grow your business - and we’ll be here to keep helping you every step of the way. Once you know why you need a loan, it will guide you in the next step as you review the different options. Thankfully there are options that offer assistance in any situation. This link takes you to the login portal for your Southern Bank credit card.

In the parlance of the industry, such properties are known as one-to-four family dwellings, and loans secured by 1-4 family dwellings are considered to be residential loans. The money will be credited to your account within a few days if you submit the paperwork and meet the eligibility requirements. The main thing to consider is what you’re going to need your loan for. From here, you can ensure that the commercial loan you choose will cater to exactly what you need.

Your credit score and debt-to-income ratio are factors that will determine how long it takes to be approved. These loans allow them to acquire capital for day-to-day operations, expansion, or other business purposes. When applying for a commercial loan you’ll need information from the documents listed above. If you have questions, commercial loan meaning you should be able to reach out to the lender for assistance. Once you’ve filled out the loan application and supplied the necessary documents, the lender will obtain underwriting approval on the loan and then it will be reviewed. After final underwriting the lender will make an offer, which takes us to the last step.

In exchange, you may be able to qualify through the SBA loan program even if your business would be rejected for a regular commercial loan. Construction Loans - These loans are used to pay for the construction of commercial buildings, residential subdivisions (tracts of houses), and residential condominium developments. Construction loans usually have a term of just one year, although a six-month extension can sometimes be negotiated for an extra point. The bank doesn’t just give the borrower $3 million and hopes he builds the apartment building, as opposed to skipping to Mexico. For example, when the grading is done, the grading contractor is paid.

Many lenders will focus on your cash flow, so it's important to keep up with financial statements because it can affect the type of business loan you receive. If you don't have the cash on hand to repay the loan, you might have trouble securing it in the first place. Short-term loans — Short-term business loans are for smaller amounts of money that you typically pay back within 18 months or less. In exchange, these loans have a simpler, faster approval process than a term commercial loan.

Chicago Atlantic Real Estate Finance Announces Second Quarter ... - GlobeNewswire

Chicago Atlantic Real Estate Finance Announces Second Quarter ....

Posted: Wed, 09 Aug 2023 11:00:00 GMT [source]

Most commercial permanent loans are made by banks, and, with the exception of multifamily properties, have a maximum term of ten years. Mortgages on multifamily properties that are provided by a government-sponsored enterprise or government agency may have terms of thirty years or more. Some commercial mortgages may allow extensions if certain conditions are met, which may include payment of an extension fee. Some commercial mortgages have an "anticipated repayment date," which means that if the loan is not repaid by the anticipated repayment date, the loan is not in defaults. A commercial and industrial loan (C&I loan) is a loan to a business rather than a loan to an individual consumer. These short-term loans may have an interest rate based on the SOFR rate or prime rate and are secured by collateral owned by the business requesting the loan.

When the conduit has amassed at least $1.5 billion of these cookie-cutter commercial loans, the pool is rated by Moody’s or Standard & Poor’s, and then the pool is securitized. Securitization means that bonds (IOU’s) are issued, secured by the loans in the pool. If you were to buy one of these bonds, you might own 1/300,000th of this pool of loans.

MCAN FINANCIAL GROUP ANNOUNCES Q2 2023 RESULTS AND ... - Canada NewsWire

MCAN FINANCIAL GROUP ANNOUNCES Q2 2023 RESULTS AND ....

Posted: Tue, 08 Aug 2023 23:51:00 GMT [source]

When it comes to securing business financing for these types of commercial loans, there's no one-size-fits-all solution. It's helpful to build a relationship with a lender who understands your needs and who's there to help find the best options to keep your business on the right track. /in/michaelbmiller

I am an experienced contracts professional having practiced nearly 3 decades in the area of corporate law and nearly a decade in the investment and finance arena.