Contents:

Sorry I didn’t see this until it was too late, but here’s my answer! This is one of those cases where QBO’s 1099 tool isn’t robust enough. I would make an account at track1099.com, which integrates with QBO, and send it from there. As of now, there is no way to correct mistakes after you’ve submitted. The next step in the wizard allows you to gather missing Contractor data. The Payments tab allows you to filter your payments by Date, Type, and Payment method.

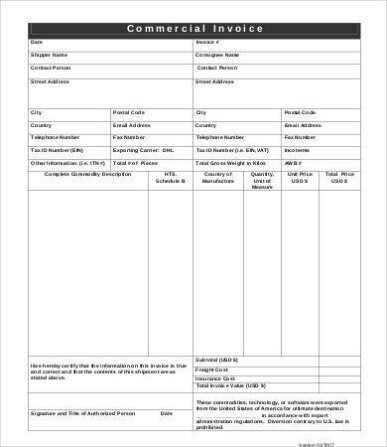

After preparing your 1099s, select the E-File option and verify your 1099s. Learn how to prepare and file your Federal 1099s with QuickBooks Online.

Box 7: Nonemployee Compensation

Click on the box at the top of the screen that says 'Prepare 1099s'. Go to the Vendors screen and choose Prepare 1099s. Thanks, I will have to go this route too. I already have a tax1099 account I think lol. I am not sure of any IRS provisions for NOT mailing copies. Company details to make sure that everything is correct.

I will be using the sample Craig’s Landscaping and Design company file. To get started, follow the below steps. Any vendor requesting a 1099 must do so through the client – no direct email to QBO staff or 1099 processing team.

pricing, and service options subject to change without notice.

I am the Financial Controller behind Goshen free xero course & Consulting. I help nonprofits and small businesses increase profitability one mission at a time. Click on the Workers tab then select Contractors.

Lastly, anyone you pay rent you must receive a 1099. Terms, conditions, pricing, special features, and service and support options subject to change without notice. Now you have the chance to review everyone that has met the threshold to file a 1099. Make sure that all of their personal information is correct. The first time you run this report you will receive a blank page. Let’s go through the process of setting up the 1099 preferences.

We e-file, e-deliver and e-correct all of these forms

Join our mailing list to receive the latest news and updates from our team. In January, transfer forms to 1099s & W-2s for e-file. Review our service offerings and apply for the service that best suits your nonprofit’s needs. Our team will review your application to determine whether we are a good fit for your organization’s needs.

If you need to file both a 1099-NEC and a 1099-MISC, you may need to adjust your account and contractor payments. This determines which types of boxes you select for the types of payments you make to non-employees. Most businesses only select “non-employee compensation” for contractor payments,. In this case, no adjustments are needed. However, if you do need to select other types of payments to report, you’ll need to do some accounting work to prepare your books.

You must complete this section to run a 1099 form. Also, check the box that says 'Track payments for 1099'. There is an option for entering the default expense account, and this is helpful for accounting purposes. You can allow QBO to securely give the 1099 information to other programs, allowing your contractors to import their data. If you are e-filing 1099 forms, QBO will send your contractors their 1099 form copy by email. You are required to provide your contractors with a 1099 form.

Any changes outside of QBO error will be an additional charge. When you’re ready, click Finish preparing 1099s. You can e-file your 1099-MISC Forms right in QBO, send copies of 1099s to subcontractors in the mail, and submit forms to the IRS. A dropdown appears from the box you select, and you can map the accounts where you have posted the payments. For example, you may choose Repairs and Maintenance or Accounting. You can pick multiple accounts.

The 1099 wizard doesn’t file with your State. You may need to take additional steps. You can submit paper forms with a checkmark in the Corrected box. The is also an option to print your own forms and send them manually. If they are, click the Back button and double-check your Box 7 accounts and Vendor transaction list.

You will receive an email from the IRS when your forms have been accepted. For all other states, you’ll need to mail in your printouts, or go to your state’s Department of Revenue website and submit your 1099s there. Use the Workers Center for paying your Employees and your Subcontractors. By using Workers as a starting point, you have a one-stop shop for running Payroll and managing contract labor.

This is to protect the client and vendor privacy. For clients who do not respond to the Proposal timely or make any changes after January 17, 2020, QBO’s fees will be $20 for all 1099s. The tax ID of the party sending the 1099 must be listed on the 1099, it cannot be masked. Once client approves the filing of the 1099s, QBO will process an auto debit against client’s bank acct for QBO’s fees.

Here’s how to get your 1099s ready to e-https://bookkeeping-reviews.com/ or print. These steps walk you through organizing your contractors and payments so your filings are correct. If you pay contractors in cash, check, or direct deposit, you'll need to file 1099s with the IRS. QuickBooks Online can help you prepare your 1099s seamlessly, using the info you already have in your account. SeeGet answers to your 1099 questionsfor more info.

© 2023 Intuit Inc. All rights

If you need help with that, you can check out our guides to bookkeeping basics in the blog section. If we are a match and depending on the service offering you need, we’ll do a discovery session to get better acquainted. We may also conduct a data file review after the session if necessary. Ufuoma Ogaga is the CEO of Goshen Accounting Services, which focuses on providing accounting, payroll, and advisory services to nonprofit organizations. If you have already filed 1099s, you can create and file additional 1099s in QuickBooks Online. Now that you've prepared and verified that the information is correct on your 1099s, it’s time to e-file.

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

Vendors/contractors are required by the IRS to report income REGARDLESS of whether or not a 1099 has been issued. While it is considered a best practice to issue 1099s, it is the vendors responsibility to report any income they received from your business. Here is where you decide if you wish to print and mail the 1099s or allow Intuit to do them for you.

Follow this article to update your company file. Follow the on-screen steps to complete your 1099 e-file. If prompted, enter your billing info.

Square vs. QuickBooks Payroll Comparison 2022 - NerdWallet

Square vs. QuickBooks Payroll Comparison 2022.

Posted: Wed, 28 Oct 2020 07:00:00 GMT [source]

The Details tab has their contact information, and you can connect their bank account to pay them directly through this interface. QBO sends the Vendor an online W-9 form to fill out electronically. Accepting the invitation creates their W-9, which flows into your QBO account. It is wise to run this report quarterly to ensure you enter all of the information correctly and promptly. All contractors who receive $600 or more per year from your organization must receive a 1099 unless they are an incorporated business. All lawyers must receive a 1099 regardless of their business structure.